НОВОСТИеще НОВОСТИ

Новости

/ 14 часов agoКапельница от запоя — что это

Капельница от запоя https://narko-medline.ru/vyvod-iz-zapoya/kapelnica/ — это метод лечения алкогольной зависимости, при котором пациенту вводят...

Новости

/ 14 часов agoПутешествуя по миру предметов первой необходимости для детей и подростков

Для родителей поиск бесчисленных вариантов предметов первой необходимости для наших детей может быть одновременно...

Новости

/ 2 дня agoПонимание виниров без подготовки: косметическое стоматологическое решение

В сфере косметической стоматологии достижение более яркой и совершенной улыбки часто сопровождается опасениями по...

Новости

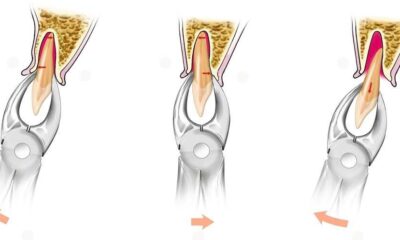

/ 2 дня agoОсновные этапы удаления зубов

Удаление зуба — процедура, при которой хирургическим путем извлекается зуб из полости рта. Это...

МИНЗДРАВеще МИНЗДРАВ

Здравоохранение

/ 1 год agoКак оформить медкнижку?

В настоящее время медицинская книжка является одним из главных документов человека, который требуется для...

Здравоохранение

/ 2 года agoАллергический ринит: симптомы и профилактика

Аллергический ринит совершенно не связан с обычной простудой и вызывается аллергической реакцией иммунных клеток...

Здравоохранение

/ 3 года agoМедицинское оборудование нового поколения

Медицина сегодня развивается очень быстро. Это касается как совершенствования методов диагностики и лечения, так...

Здравоохранение

/ 3 года agoРегистрация медицинских изделий

Регистрация товаров, размещенных на рынке, является обязательной процедурой, подтверждающей их безопасность и качество для...

БИЗНЕСеще БИЗНЕС

Бизнес

/ 1 год agoАутсорсинг персонала — в чем заключается концепция?

Наем сотрудников и управление ими — это трудоемкий и дорогостоящий процесс для компаний. Тем...

Бизнес

/ 4 года agoКак проходит ТО компрессоров

ТО – это аббревиатура от «технический осмотр». Для проведения ТО по компрессорам к нему...

Бизнес

/ 4 года agoПродвижение аккаунтов: основные нюансы

Социальные сети — это интерактивные площадки, позволяющие общаться с друзьями и знакомыми, а также...

Бизнес

/ 5 лет agoКомпания «Валента Фарм» выводит на рынок Граммидин® спрей с анестетиком

Компания «Валента Фарм» выводит на рынок Граммидин® спрей с анестетиком – уникальную комбинацию местного...

НАУКАеще НАУКА

Наука и жизнь

/ 10 месяцев agoПознайте плюсы аяваски: целебные свойства и потенциал для духовного развития

Целебные свойства аяваски Аяваска, известная также как «древняя лекарственная настойка», является отваром, приготовленным из...

Наука и жизнь

/ 1 год agoИзбавление от рубцов и шрамов

Шрамы или рубцы являются естественным проявлением заживления тканей после травмы или хирургического вмешательства. После...

Наука и жизнь

/ 1 год agoКак познакомиться с богатым мужчиной: лучшие сайты знакомств

Мечта 99% девушек – это богатый муж. В женщине генетически заложено, что мужчина —...

Наука и жизнь

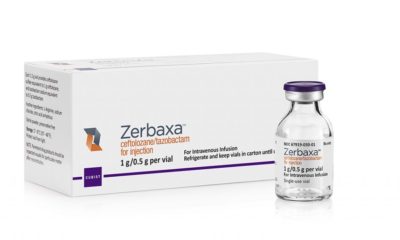

/ 5 лет agoВ России зарегистрирован инновационный антибиотик ЗЕРБАКСА

Москва, 14 ноября 2018 г. – Международная биофармацевтическая компания Merck Sharp & Dohme (MSD),...